According to REcolorado MLS data, the Denver Metro housing market has more homes actively available for sale than we’ve seen in nearly 5 years. Standing inventory, or the number of homes actively for sale, jumped 65% year-over-year to 9,029 units. This marks a notable milestone, as it signifies a return to pre-pandemic levels of active listings.

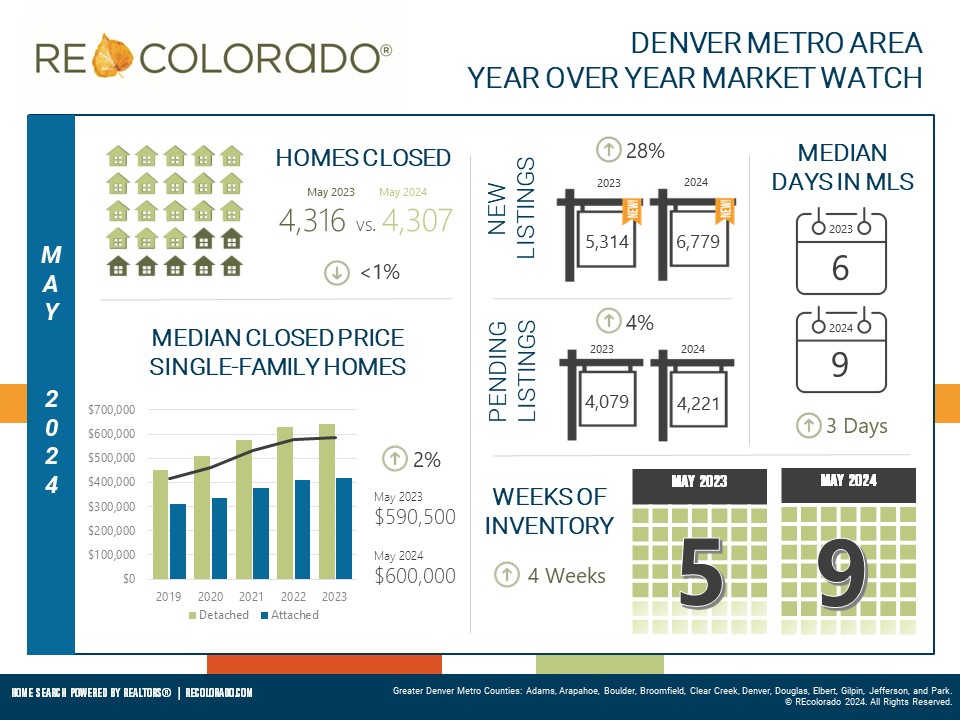

The increase in inventory is the result of the influx of new listings outpacing buyer demand. Buyers added 6,779 properties to the market in May, reflecting a 28% increase from last year at this time and an 11% uptick from April 2024. This trend marks the fifth consecutive month of growth for new listings in the Denver Metro area. During the same period, buyer activity remained steady with 4,221 contracts signed in May.

Despite the inventory shift, closing prices held firm, increasing 2% year-over-year. The number of closings in May was marginally lower than last year but showed a 12% increase from April 2024.

Bright Spot

The bright spot in the Denver Metro area housing market is the $1-2M price range, which saw the largest jump in new listings to hit the market in May, up 44% from last year. Buyer activity was strong in this price range, as well, with closings up 22% year-over year. These homes spent a median of just 8 days on the market.

Echoing National Trends

The shift that is taking place in the Denver market aligns with national trends highlighted in the Fannie Mae Home Purchase Sentiment Index® (HPSI) released on June 7, 2024. The index indicates a decline in consumer sentiment towards homebuying, with a record low of only 14% believing it’s a good time to buy. Rising mortgage rates and affordability concerns are likely contributing factors. However, the survey also suggests a potential increase in future listings, as some homeowners may be motivated to sell due to non-financial reasons.

Overall, the Denver Metro housing market is transitioning towards a more balanced landscape. While buyer activity remains healthy, the significant rise in inventory suggests a potential cooling off period for the previously seller-dominant market. This aligns with forecasts predicting improvements in housing inventory nationwide.

Denver Metro Rental Market

The Denver Metro rental market also experienced some fluctuation. Although the number of leased properties dipped slightly compared to both May 2023 (3%) and April 2024 (6%), the median lease price rose by 5% year-over-year. Additionally, new rental listings jumped 18% from April, with 487 properties added to the market. The month ended with 523 active rentals available, reflecting a 13% increase from the previous month.