January – December 2022

The real estate market in the Denver Metro Area started out strong in January and stayed that way for the first half of the year, with many sellers receiving multiple bids and all-cash offers from motivated buyers. Contracts were written on homes at a record pace in the spring of 2022 with homes spending a median of just four to five days actively available for sale.

As interest rates rose, the market slowed dramatically. Although home prices weren’t seeing double-digit increases, they remained at record high levels. Those high prices combined with higher interest rates made affordability a key factor for potential home buyers in 2022 and put home ownership out of reach for many. On the other side, sellers found their homes sitting on the market longer, from three to four weeks in the late summer and fall. Inventory remained low as existing homeowners had little incentive to sell and buy again when they had already locked in lower mortgage rates.

Looking ahead to 2023, most economic forecasters agree that interest rates have likely peaked, which could entice homebuyers back into the market. Home affordability and lack of inventory, especially affordable options, is likely to be the primary challenge in the coming year as potential sellers choose to stay in place.

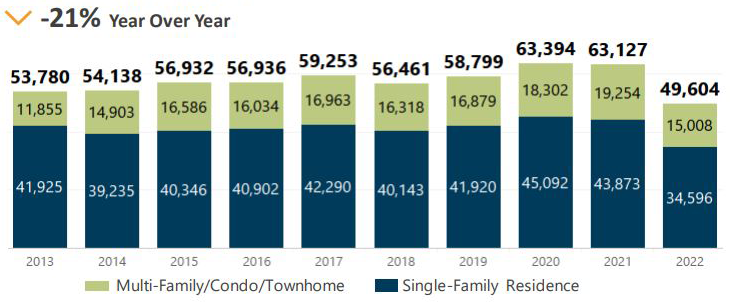

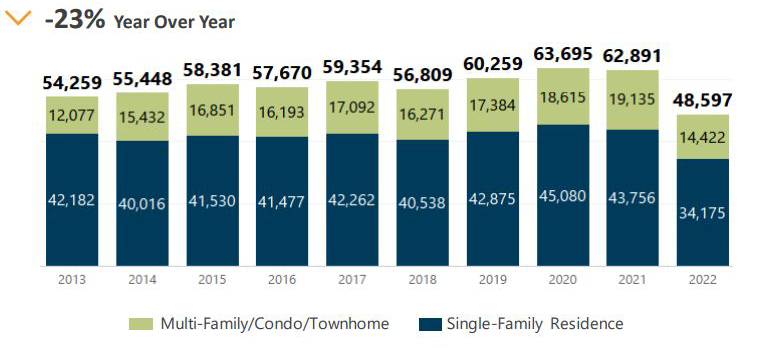

Closed Listings

Closing activity was strong during the first part of the year, with the number of closed

listings at or above pre-pandemic levels. Sales of residential properties in the Denver

Metro Area peaked in May and then declined for six of the seven following months as interest

rates climbed. As a result, the year ended with 21% fewer closings than 2021 and less

closings than we’ve seen in more than a decade.

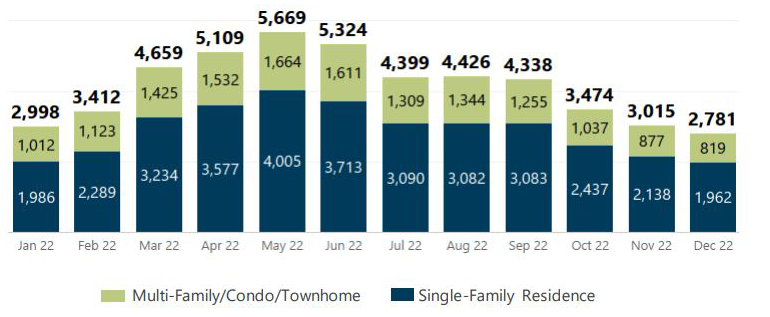

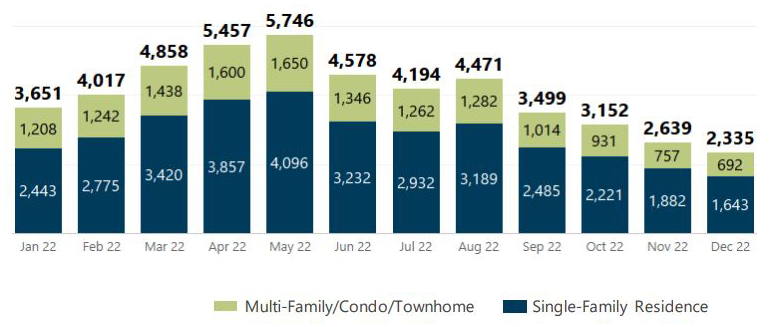

Closed Listings by Month

Pending Listings

Home shoppers took advantage of increased inventory levels and low interest rates during the first part of 2022. However, as interest rates increased, buyer activity dropped off as did the number of pending listings. During 2022, there were 23% fewer contracts executed on residential properties than we saw in 2021.

Pending Listings by Month

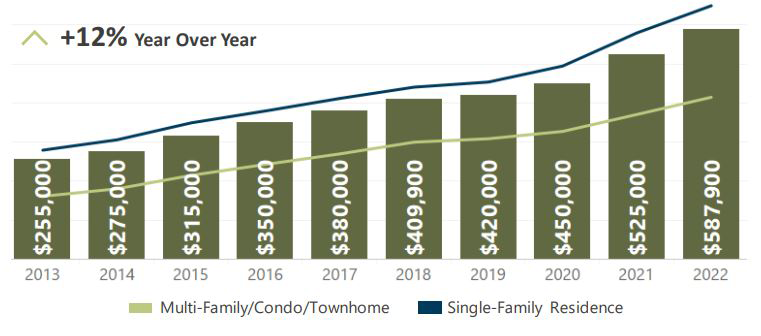

Closed Prices

The median closed price of a residential property was 12% more than in 2021—and 55% higher than five years ago! In the Spring, buyers paid an average of 6.8% more than the original list price. However, home price growth did slow during the second part of the year as demand eased. The end of 2022 brought price reductions and sellers who were willing to accept offers lower than the original price they listed. In December, buyers paid an average of 5.7% less than the original list price.

The most active price range, in terms of closings in 2022, was $500-600,000, which represented 20% of all residential property sales. While closings decreased overall in 2022, there was an increase in sales in every price range above $700,000 as home prices remained high. Closings of homes priced above $700,000 increased 5% from 2021 to 2022.

Median Closed Price

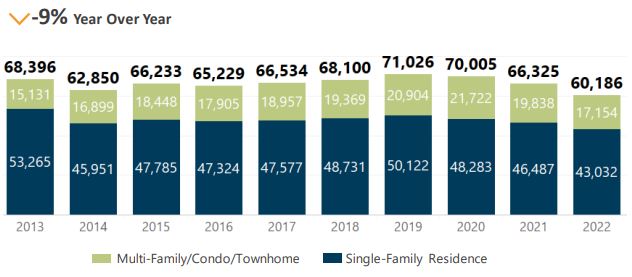

New Listings

In 2022, sellers and home builders brought less new inventory to the market than we’ve seen in more than 10 years. The $500,000-$600,000 price range saw the most fresh listings in 2022. The number of new listings in the $400,000-$500,000 range fell 30% from last year. The number of New Listings priced above $600,000 increased 22% compared to last year, which gave buyers more choice.

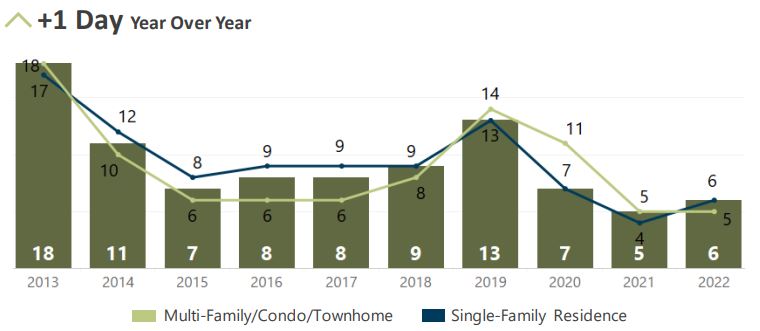

Days in MLS

The pace of sales slowed considerably throughout the year. During the first part of 2022, contracts were executed on homes in a median of four to five days. As demand decreased in the second part of the year, median days in MLS increased significantly. In December, properties were actively for sale in the MLS for a

median of 31 days.

Median Days in MLS