As the Denver metro area entered 2025, the housing market showed resilience, with sellers bringing more inventory to the market and buyers staying engaged. Despite seasonal trends, January reflected steady home prices, an increase of new listings, and a competitive environment.

Year-Over-Year Insights

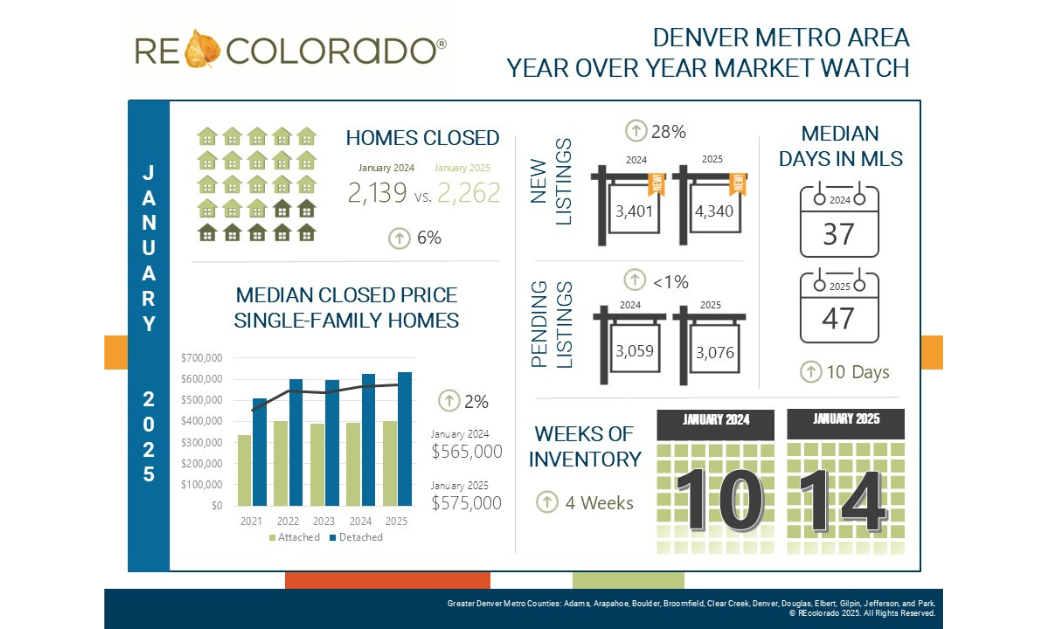

The new year kicked off with increased seller activity, as 4,340 new listings hit the market—a 28% increase from January 2024. This expanded inventory provided buyers with more choices, contributing to a 6% year-over-year increase in closed listings, with 2,262 homes sold this month. Home prices remained stable, with the median closed price rising nearly 2% year-over-year to $575,000. The market continued to see strong buyer interest with 3,076 properties going under contract, a slight increase over last year. However, homes spent more time on the market, with the median days in the MLS increasing to 47 from 37 last January, indicating that buyers are taking more time to finalize their decisions.

Month-Over-Month Insights

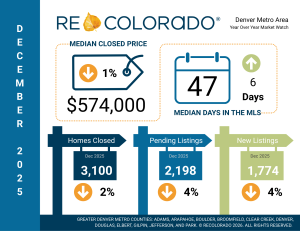

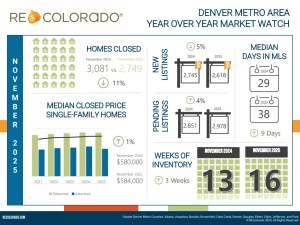

January brought a surge in new listings, more than doubling from December with a 130% increase. Despite this, closed sales declined 29% month-over-month, reflecting a slower start to the year in terms of finalized transactions. However, pending listings rose by 32%, suggesting buyer demand is picking up. The median closed price dipped slightly to $575,000 from $579,975 in December, while homes took longer to sell, with median days in MLS increasing from 41 in December 2024 to 47 in January 2025.

January Inventory and Pricing Trends

Denver metro’s active inventory at the start of 2025 saw a modest decline compared to last month, aligning with seasonal trends. The average closed price per square foot stood at $323, and homes sold for an average of 96% of their original list price, reflecting stable pricing dynamics. Attached homes had a median closed price of $399,925, while detached single-family homes sold at a median of $635,000. Attached properties also experienced slightly longer market times, with a median of 51 days compared to 46 days for detached homes.

Denver Metro Rental Market

The rental market started the year with a slowdown as 252 properties were leased through REcolorado’s MLS, an 18% decrease from January 2024. This marked only a slight dip from December 2024, when 264 rentals were leased. The median leased price stood at $2,625, reflecting a small decrease both year-over-year and month-over-month. New rental listings declined 13% annually but rebounded from December’s total of 260. Active rental inventory tightened, with 557 available properties—a 7% decrease from last year—signaling continued demand despite reduced lease activity.

Looking Ahead

With an influx of new listings and steady buyer interest, 2025 is shaping up to be an active year for the Denver metro housing market. As inventory expands, buyers will have more choices, and sellers may need to adjust expectations to remain competitive.