Year-Over-Year Insights

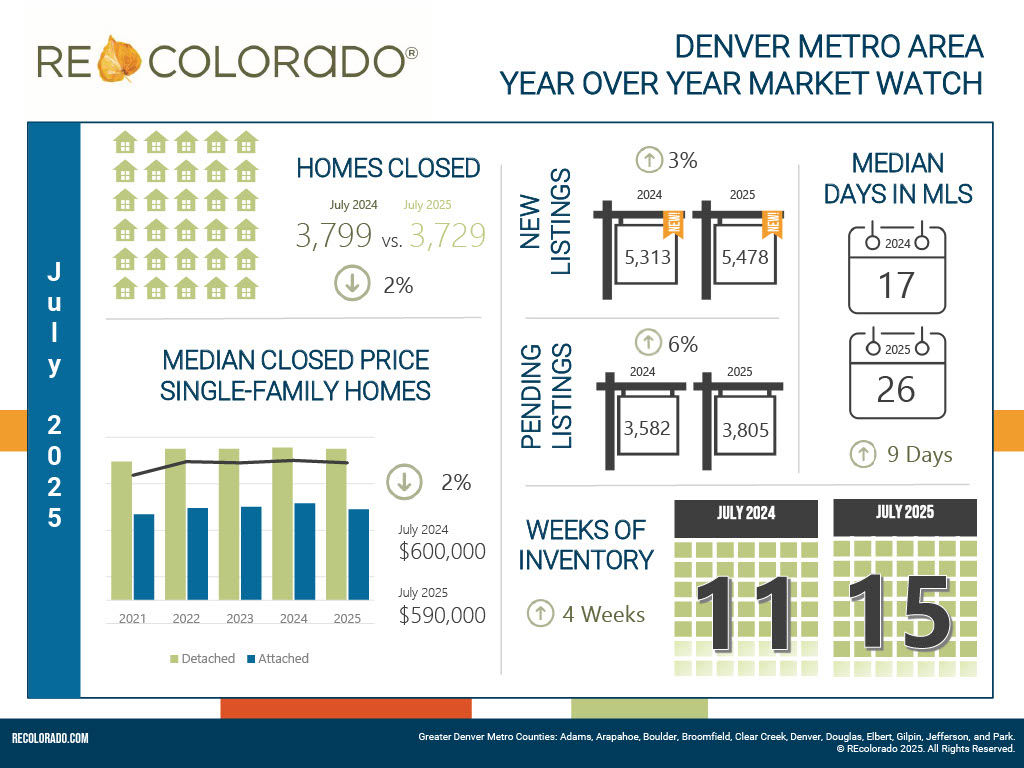

The Denver Metro housing market continued to shift toward balance in July, offering buyers more leverage while requiring sellers to be strategic. For buyers, rising inventory and longer time on market mean more options and flexibility. With homes spending a median of 26 days in the MLS—nine days longer than last year—and the median closed-to-original list price ratio dropping to 97.3%, there is more room to negotiate and less pressure to act quickly. Sellers are still seeing solid activity. Although new listings are up 3% and pending sales rose 6% year over year, closed transactions dipped 2%. The median sale price fell slightly to $590,000, down 2% from July 2024. This cooling indicates buyers are active but increasingly value-conscious. Pricing new listings accurately is more important than ever.

Month-Over-Month Insights

In July, the Denver Metro housing market slowed slightly compared to the previous month. New listings fell 7%, pending sales dipped 1%, and closed listings declined 7%, signaling a seasonal cooling in activity. The median closed price also decreased by 3%, while homes spent an additional seven days in the MLS. For buyers, this shift may offer more negotiating power and less competition. For sellers, it highlights the importance of strategic pricing and preparation, as homes are taking longer to sell and buyers are becoming more selective.

Denver Metro Rental Market

The Denver Metro rental market remained active in July, with leased properties up 19% year over year, indicating strong demand. However, the median leased price dipped 3%, and the median days in MLS rose to 24—three days longer than last year—suggesting renters have slightly more time and choice. The price per bedroom declined 2%, while the leased price per square foot increased by 4%, pointing to growing interest in smaller or more efficient rental spaces.