The Denver Metro housing market experienced a slight cooling in July, as is typical during the summer months. While the market continues to show signs of adjustment, there are also positive indicators for both buyers and sellers.

Sales and Prices

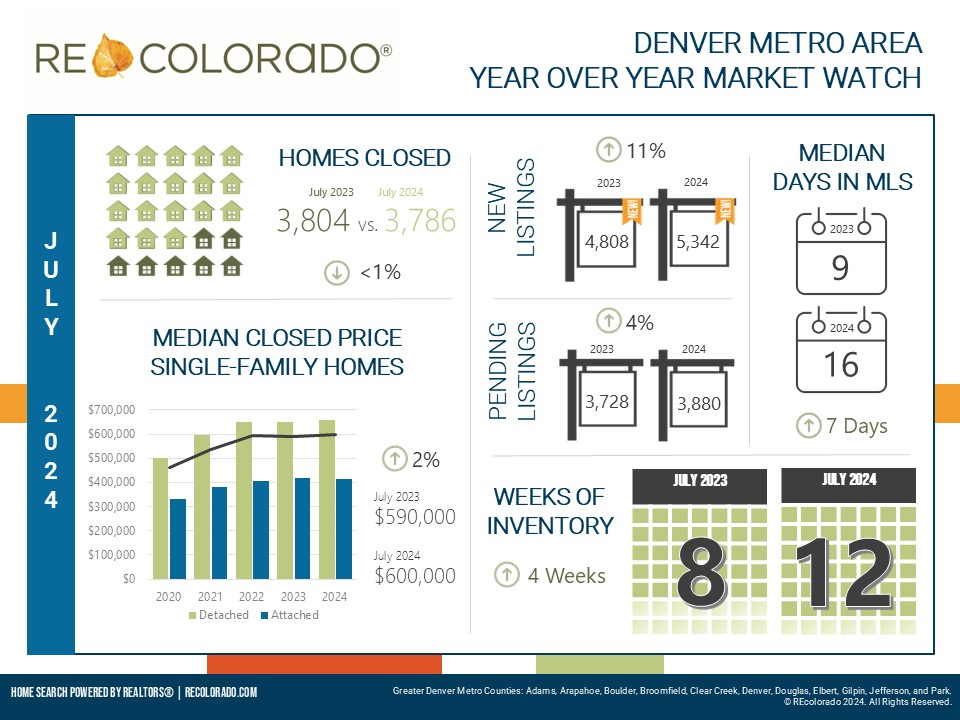

According to REcolorado MLS data, the number of home closings in July dipped slightly compared to the previous year and month, suggesting a more balanced market. Despite this, the median closed price for Denver Metro homes remained steady at $600,000, marking a 2% increase from the same time last year.

Inventory and Competition

A notable trend in July was the increased inventory of homes available for sale. New listings were up 11% compared to the previous year, contributing to the highest inventory levels seen in a decade. With more choices available, buyers have had slightly more leverage in the market. Consequently, homes are spending more time on the market. The median time for homes to go from active to pending status increased to 16 days in July, a week longer than the previous year.

Impact of Falling Interest Rates

A significant development in July was the accelerated decline in mortgage rates. Following a cooler-than-expected jobs report and expectations of a Federal Reserve rate cut, the 30-year fixed mortgage rate dropped to 6.8%, the lowest point of the year. This decrease could potentially reignite buyer interest in the coming months.

Rental Market

The rental market in Denver Metro also saw activity in July. The number of leased properties increased by 6% compared to the same period last year, with a median leased price of $2,995. Additionally, new rental listings were up 15% year-over-year.

Overall, the Denver Metro housing market is experiencing a period of adjustment. While sales have cooled slightly, inventory levels are rising, and prices remain relatively stable. The recent decline in interest rates may inject new energy into the market in the months ahead.